Vat Invoices Template

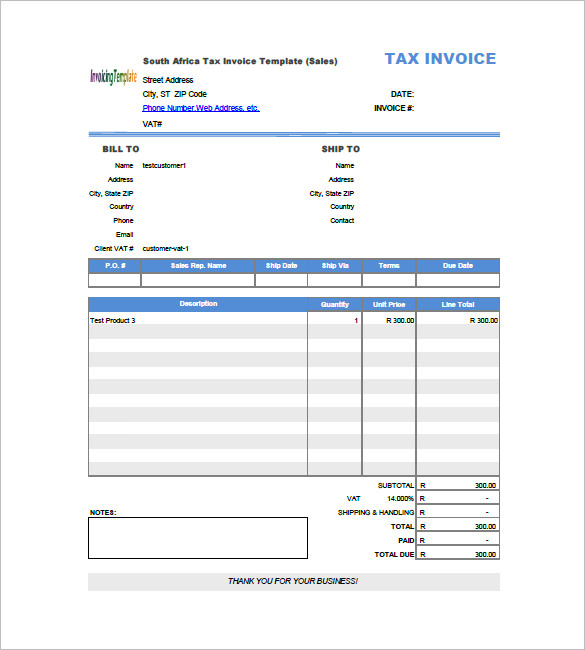

A VAT invoice is a kind of commercial document or paper which includes the calculation of VAT paid by the customer or client. Only VAT-registered businesses can issue VAT invoices and this type of invoice must be used if you and your customer are registered for VAT with HMRC.

Free Value Added Tax Vat Invoice Template Pdf Word Excel

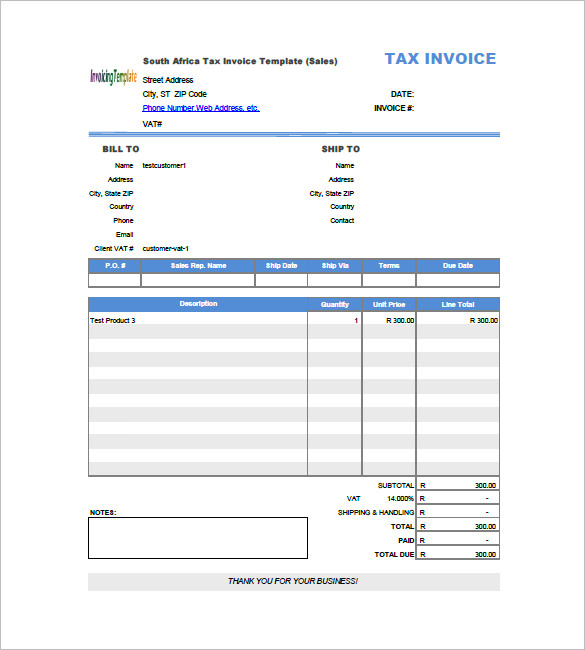

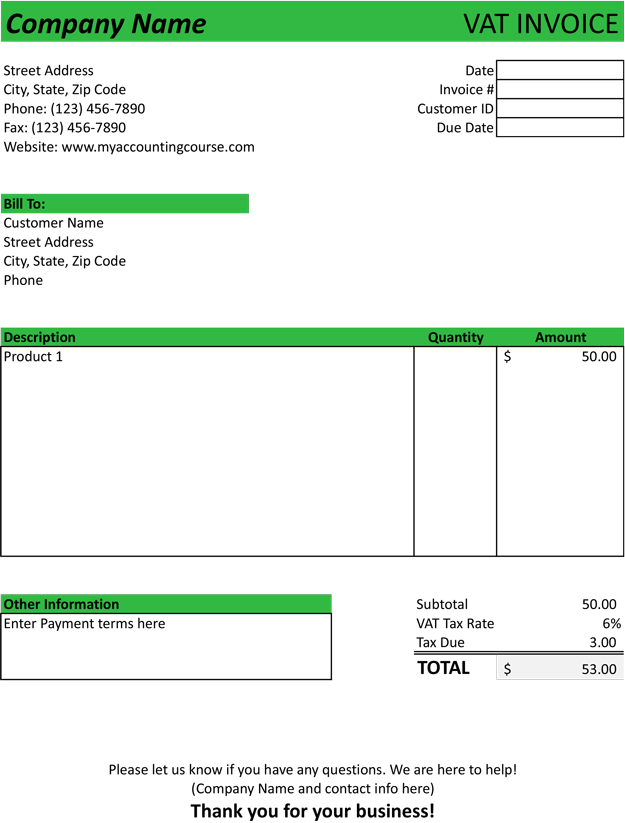

For most countries outside the United States a VAT tax is a percentage of the value of a product.

. Click on the Gear icon. Look Professional - Make a good impression with this clear and intuitive invoice. To clearly outline the VAT you need a VAT invoice.

Ad Create professional PDF invoices in seconds with the template gallery. Header section of the VAT invoice template. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy To Understand Financial Reports.

Templates Made With Artificial Intelligence - Simple Comprehensive - Subscribe Today. FreshBooks Provides Easy-To-Use Double-Entry Accounting Tools To Run Your Small Business. Select Custom and styles.

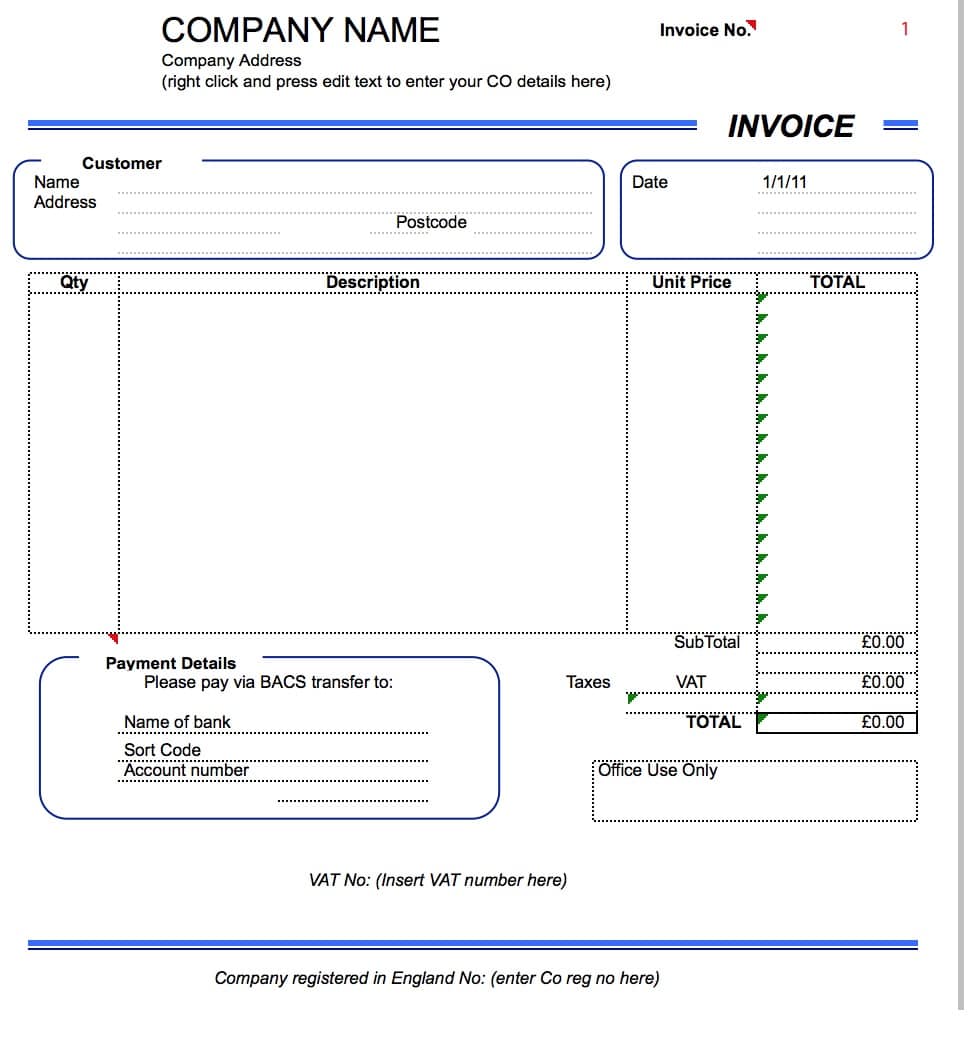

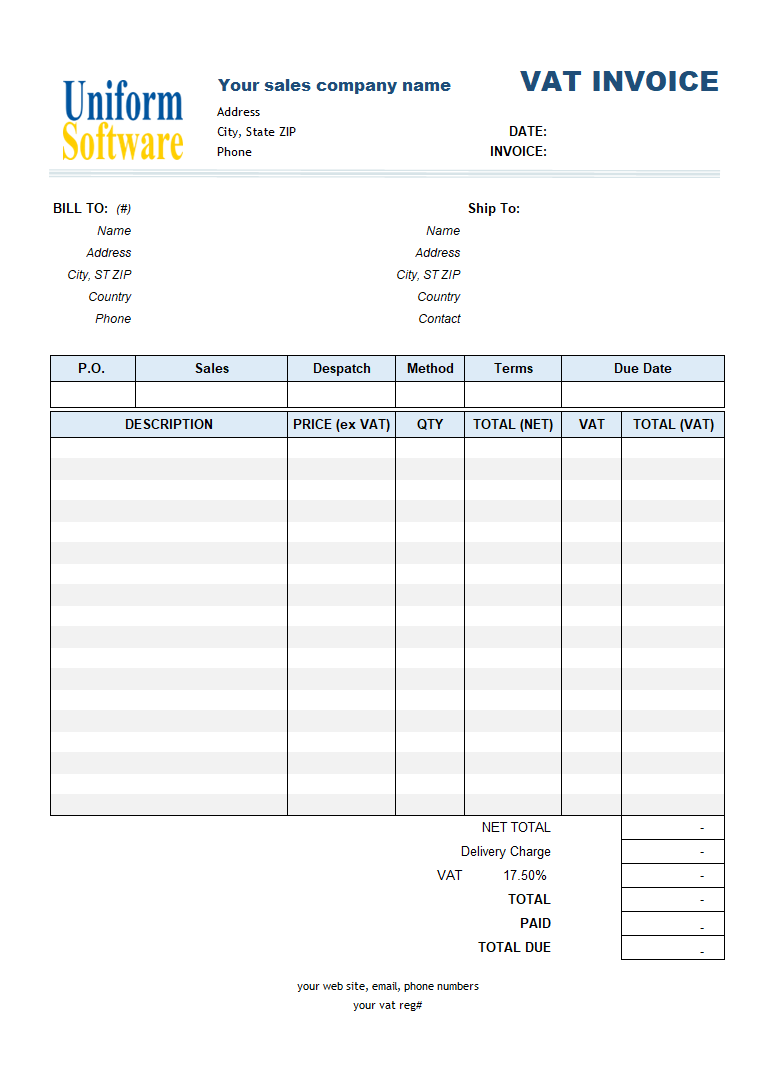

FreshBooks Provides Easy-To-Use Double-Entry Accounting Tools To Run Your Small Business. The VAT invoice is for countries that require businesses to pay a value-added tax for goods that exchange from one 1 party to another. At the top of the document should be a caption that identifies the bill as a VAT.

We know how important this is which is why we have this. Youll also find invoicing templates and billing statements that deduct deposits or provide tax calculations. Free Invoice Templates - Excel Word PDF.

Value Added Tax VAT is an important part of the dues that your client owes you. Add Discounts add more fields if applicable and print save as PDF or email the invoice to your. Ad Send Customized Invoices Easily Track Expenses More.

Generate an instant professional invoice by downloading our blank invoice template in Microsoft Excel Word Adobe PDF or by using. Free beautiful invoice templates that make getting paid on time painless. Depending on the country.

Ad Free Invoice Template for small businesses designed to increase sales. 2 Customize Email Print- Start Before 815. Usually VAT invoices should be.

A VAT invoice is used when selling goods with an added VAT tax. You can even download an invoice template that lets you sign up for Microsoft. Registered business owners usually track their VAT payments in order to claim credits for such payments.

Ad 1 Download Sample Invoices. WeInvoice provides you with. Create and send PDF invoices using 100 professional templates.

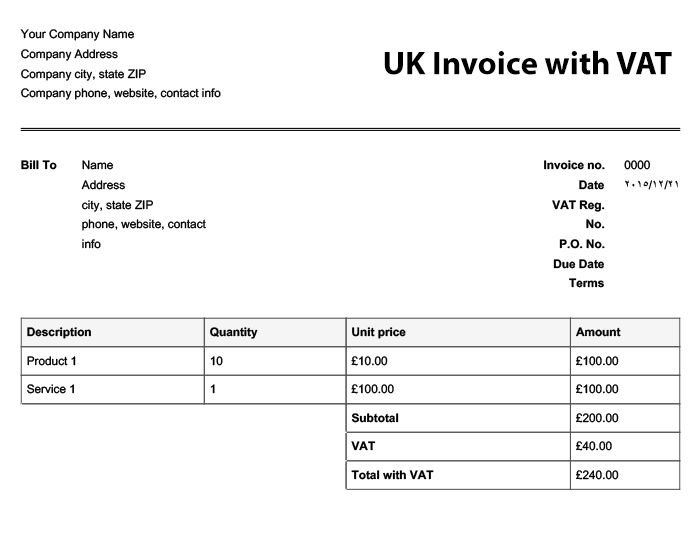

For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Step 1 Your business complete name and address. Free UK Invoice Template with VAT.

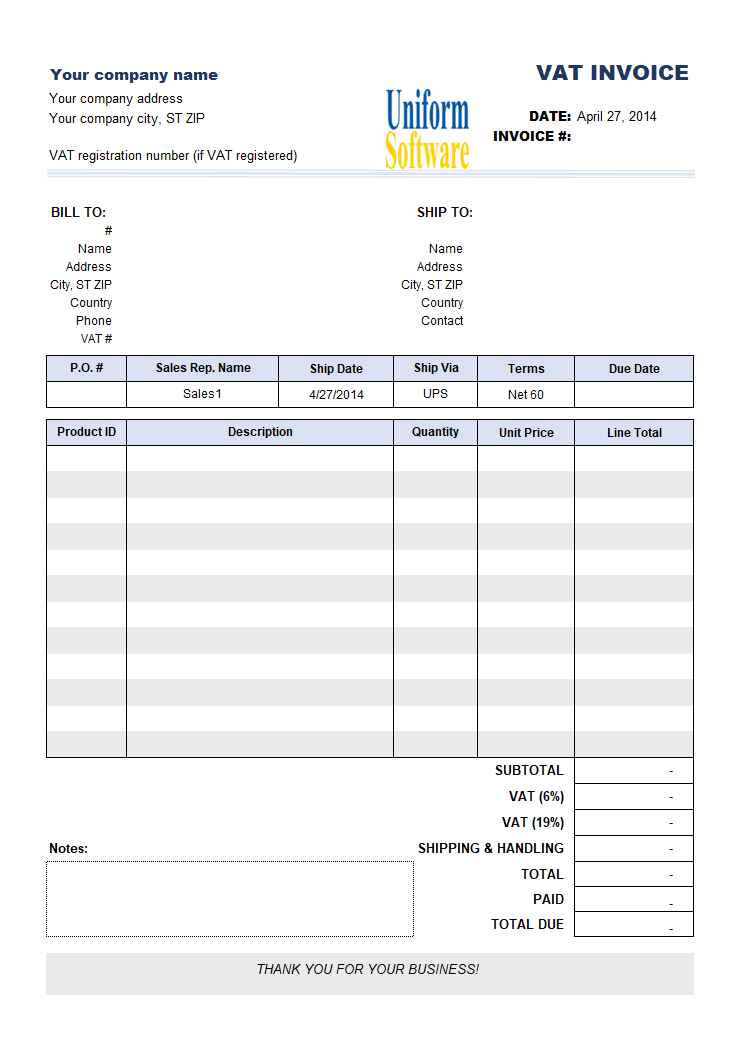

Click on the drop-down arrow in the New style tab then choose Invoice. Select the Content tab and click the invoice template. See the session of a typical VAT invoice template.

Up to 30 cash back Your VAT Invoice format should have the following details. Ad Find the free template that fits your business and send invoices in minutes. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

Every registered business should have this first and. The top section of this VAT Invoice Template is intended to record details related to the invoices issuer such as your registration and VAT numbers. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy To Understand Financial Reports.

Add or edit the Taxes from the Set Taxes button. Usually the document is electronically generated and its format. Ad Send Customized Invoices Easily Track Expenses More.

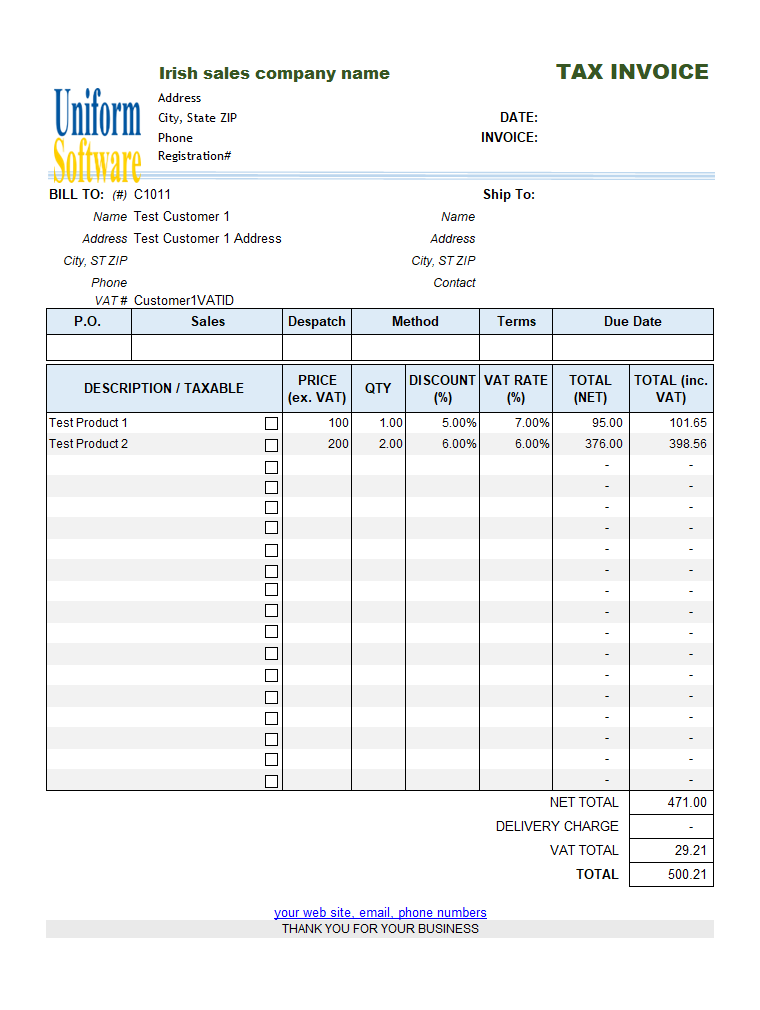

Irish Sales Vat Invoice Template

Free Vat Invoice Template Free Download In Pdf Bonsai

Free Uk Invoice Template With Vat Online Invoices

Vat Sales Invoicing Sample Price Excluding Tax

Vat Invoice Template Sample Form Free Download Pdf Excel Word

6 Invoice Template With Value Added Tax Doc Pdf Free Premium Templates

Vat Invoicing Sample With 2 Separate Rates

What Is A Vat Invoice Charging Value Added Tax To Eu Clients

Comments

Post a Comment